A) Tax hikes or spending cuts intended to reduce aggregate demand.

B) Tax hikes or spending cuts intended to increase aggregate demand.

C) Tax cuts or spending hikes intended to increase aggregate demand.

D) Tax cuts or spending hikes intended to reduce aggregate demand.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

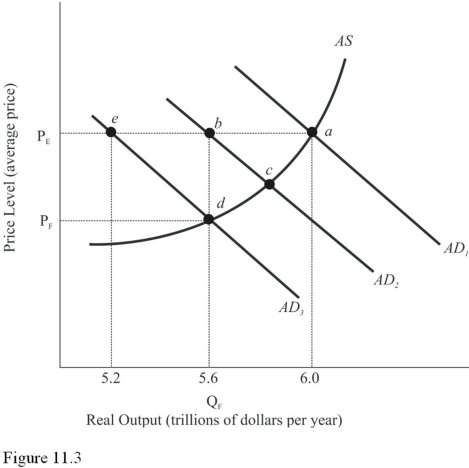

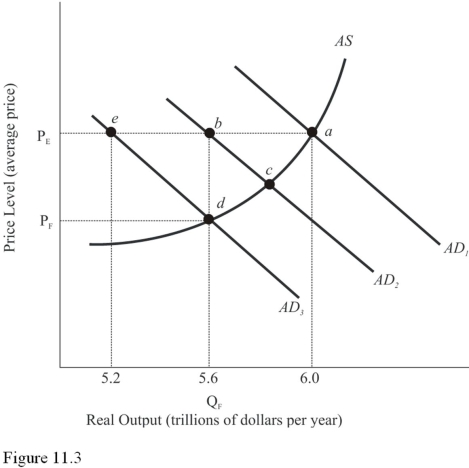

Refer to Figure 11.3.Assume aggregate demand is represented by AD1 and full-employment output is $5.6 trillion.The economy confronts an inflationary GDP gap of

Refer to Figure 11.3.Assume aggregate demand is represented by AD1 and full-employment output is $5.6 trillion.The economy confronts an inflationary GDP gap of

A) $200 billion.

B) $400 billion.

C) $600 billion.

D) $800 billion.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The second crisis of economic theory refers to

A) The typical fiscal policy trade-off between unemployment and inflation.

B) The dominance of Keynesian views in fiscal policy to the exclusion of newer,more enlightened viewpoints.

C) An emphasis on the level of output without concern for the content of output in terms of fiscal policy.

D) Our inability to maintain full employment output over any significant period of time.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The general formula for calculating the desired fiscal stimulus is

A) AD shortfall × the multiplier.

B) 1/(AD shortfall × the multiplier) .

C) AD shortfall ÷ the multiplier.

D) 1/(AD shortfall ÷ the multiplier) .

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

An example of fiscal policy occurs when the government decreases corporate income taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a policy option to eliminate an AD shortfall?

A) Decrease government purchases.

B) Reduce taxes.

C) Reduce transfer payments.

D) All of the choices are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would cause both an increase in the price level and an increase in real output?

A) A tax hike.

B) A decrease in production costs.

C) An increase in transfer payments.

D) A decrease in government spending.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The World View article in the text titled "China Sets Big Stimulus Plan in Bid to Jump-Start Growth" states that China's plan includes spending in housing,infrastructure,and agriculture,as well as a tax deduction for capital spending by companies.These policies will cause the aggregate

A) Demand curve to shift to the left.

B) Supply curve to shift to the left.

C) Demand curve to shift to the right.

D) None of the choices are correct.

F) B) and C)

Correct Answer

verified

C

Correct Answer

verified

True/False

Income transfers become part of aggregate demand as soon as they occur.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government decides to increase taxes by $50 billion and to increase transfer payments by $50 billion.What effect would there be on aggregate demand?

A) No impact.

B) $50 billion increase.

C) More than $50 billion increase after the multiplier effect.

D) $50 billion decrease.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The total change in aggregate spending generated by increased government spending depends on the

A) Marginal propensity to consume.

B) Size of the recessionary GDP gap.

C) AD shortfall.

D) AD excess.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Fiscal policy formation causes a delay in implementation even though a recession can usually be recognized within a few weeks after it begins.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

The inflationary GDP gap differs from the AD excess when

A) The aggregate supply curve slopes upward.

B) The multiplier effect raises spending.

C) The aggregate supply curve is horizontal.

D) There is a time lag in the implementation of fiscal policy.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following explains why the government should not increase spending by the entire amount of the AD shortfall to move the economy to full employment?

A) Price level changes will make up for the difference between the fiscal stimulus and the AD shortfall.

B) The multiplier process will contribute to an additional increase in aggregate demand that will cause an inflationary gap.

C) The government can increase taxes to create an additional increase in aggregate demand.

D) The price level is constant.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the desired fiscal restraint is $80 billion and the AD excess is $160 billion,we can conclude that

A) The MPS is 0.50.

B) The multiplier is 0.50.

C) There is a recessionary gap.

D) The MPC is 2.0.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a diagram of aggregate demand and supply curves,the AD shortfall is measured as the

A) Vertical distance between the equilibrium price and the price at which the aggregate demand would intersect aggregate supply at full employment.

B) Horizontal distance between the equilibrium output and the full-employment output.

C) Horizontal distance between the aggregate demand curve necessary for full employment and the aggregate demand curve that intersects AS at the equilibrium price.

D) Vertical distance between the recessionary GDP gap and the inflationary GDP gap.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the MPC is 0.80.If the government wants to eliminate an AD shortfall of $300 billion,it should

A) Cut taxes by $75 billion.

B) Cut taxes by $240 billion.

C) Increase taxes by $60 billion.

D) Cut taxes by $60 billion.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If aggregate demand increases by the amount of the recessionary GDP gap and aggregate supply is upward-sloping,

A) The economy will move to full employment.

B) An AD surplus will occur.

C) A recessionary GDP gap will still exist.

D) An inflationary GDP gap will develop.

F) A) and B)

Correct Answer

verified

C

Correct Answer

verified

True/False

It is impossible for the government to maintain a balanced budget while using fiscal policy to eliminate a recessionary gap.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-Refer to Figure 11.3.Assume aggregate demand is represented by AD1 and full-employment output is $5.6 trillion.To restore price stability,the AD curve must shift

-Refer to Figure 11.3.Assume aggregate demand is represented by AD1 and full-employment output is $5.6 trillion.To restore price stability,the AD curve must shift

A) Leftward by $400 billion.

B) Leftward by $800 billion.

C) Rightward by $400 billion.

D) Rightward by $800 billion.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 133

Related Exams