A) decrease its loans by $100 million.

B) decrease its loans by $10 million.

C) decrease its loans by $9 million.

D) increase loans by $9 million.

E) increase loans by $10 million.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Until recently, and for many years, the common definition of the money supply used by the Bank of Canada was M1, which included currency in circulation plus

A) chequable deposits at the chartered banks.

B) chequable deposits and savings accounts at the chartered banks.

C) savings accounts and demand loans.

D) term deposits and money market funds.

E) chequable deposits at all financial institutions.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

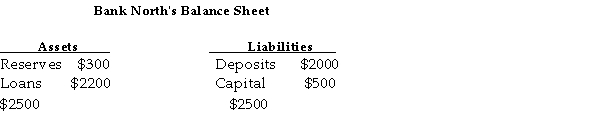

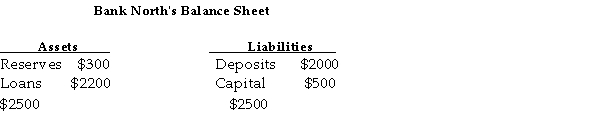

TABLE 26-2

-Refer to Table 26-2. What are the income-earning assets for Bank North?

TABLE 26-2

-Refer to Table 26-2. What are the income-earning assets for Bank North?

A) Reserves

B) Loans

C) Deposits

D) Capital

E) Liabilities

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things being equal, a rise in the price level will

A) increase the value of money.

B) decrease the purchasing power of money.

C) stabilize the value of money.

D) increase the purchasing power of money.

E) have no effect on the value of money.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Bank ABC has a target reserve ratio of 10%, no excess reserves, and it receives a new deposit of $500 000) This bank will initially expand its loans by

A) $50 000.

B) $450 000.

C) $500 000.

D) $4.5 million.

E) $5 million.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Canadian commercial banks maintain their reserves in the form of

A) cash in their bank vaults and deposits at the Bank of Canada.

B) cash in their bank vaults.

C) gold in their bank vaults.

D) deposits at other commercial banks that are immediately accessible.

E) cash and foreign currency at the Bank of Canada.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If all the commercial banks in the banking system collectively have $300 million in cash reserves and are satisfying their target reserve ratio of 20%, what is the amount of deposits they have?

A) $0

B) $60 million

C) $600 million

D) $1500 million

E) $2000 million

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a commercial bank has a level of target reserves of $500 million and actual reserves of $575 million. This bankʹs is/are $75 million.

A) profits

B) fractional reserves

C) excess reserves

D) reserve ratio

E) cash drain

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In recent years, the use of debit cards issued by commercial banks has skyrocketed. When you pay for a purchase at a store using a debit card, you are

A) authorizing the transfer of cash from your bank account to the merchantʹs bank account.

B) creating an electronic debt to the merchant.

C) authorizing an electronic transfer of a money substitute from you to the merchant.

D) authorizing an electronic transfer of deposit money from you to the merchant.

E) authorizing the transfer of bank notes from you to the merchant.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

TABLE 26-2

-Refer to Table 26-2. If Bank North receives a new deposit of $400, its actual reserve ratio immediately becomes

TABLE 26-2

-Refer to Table 26-2. If Bank North receives a new deposit of $400, its actual reserve ratio immediately becomes

A) 7%.

B) 15%.

C) 25%.

D) 29%.

E) 35%.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When metal coins, such as gold and silver, were used as money, a technique which helped to prevent the reduction of their value through clipping was

A) basing.

B) re-minting.

C) milling.

D) debasement.

E) sweating.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider a new deposit of $10 000 to the Canadian banking system. The bank that initially receives this deposit will find itself with

A) no excess reserves if there is no reserve requirement.

B) $1000 of excess cash reserves if its target reserve ratio is 10%.

C) $2000 of excess cash reserves if its target reserve ratio is 10%.

D) $8000 of excess cash reserves if its target reserve ratio is 20%.

E) $10 000 of excess cash reserves if its target reserve ratio is 100%.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

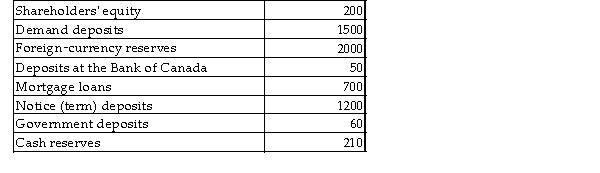

Consider the following list of entries that might appear on the balance sheet of a commercial bank. All figures are millions of dollars.  TABLE 26-1

-Refer to Table 26-1. What are the total liabilities on the balance sheet of this commercial bank?

TABLE 26-1

-Refer to Table 26-1. What are the total liabilities on the balance sheet of this commercial bank?

A) 2410

B) 2520

C) 2810

D) 2960

E) 3160

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When you pay for your $74 purchase at the grocery store with a debit card, you are

A) transferring $74 of currency from your bank account to the grocery storeʹs bank account.

B) withdrawing $74 from your bank account with which you pay for your groceries.

C) transferring your claim on $74 worth of gold to the grocery store.

D) electronically transferring $74 of deposit money from your bank account to the grocery storeʹs bank account.

E) essentially promising the grocery store that your bank will pay them $74 at the end of the month when debts are settled.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The functions of the Bank of Canada include

A) acting as the lender of last resort for the largest private corporations.

B) acting as banker for the commercial banks.

C) regulating both the money market and stock market.

D) setting the exchange rate for the Canadian dollar on world markets.

E) providing deposit insurance at Canadian commercial banks.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Bank of Canada enters the open market and purchases $1000 of government securities, what will be the eventual change in the money supply given a 10% target reserve ratio in the commercial banking system?

A) decrease of $1000

B) decrease of $5000

C) decrease of $10 000

D) increase of $5000

E) increase of $10 000

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about deposit money is true?

A) The quantity of fiat money in the Canadian economy far exceeds the quantity of deposit money.

B) Deposit money can legally be created solely by the Bank of Canada.

C) Deposit money is the paper money or coinage that is decreed by the government to be accepted as legal tender.

D) Deposit money is recorded as an asset on the balance sheet of a commercial bank.

E) The quantity of deposit money in the Canadian economy far exceeds the quantity of fiat money in circulation.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The largest component of the liabilities of the Bank of Canada is

A) Government of Canada securities.

B) Government of Canada deposits.

C) Canadian currency in circulation.

D) deposits of commercial banks and other financial institutions.

E) loans to private individuals.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of the use of money as a medium of exchange?

A) Dave keeps $250 in his drawer for a ʺrainy day.ʺ

B) Mike gets a friend to give him a beer today in return for promising to give the friend two beer when Mike gets paid at the end of the month.

C) Judy lends her car to a friend who signs a promissory note that she will pay Judy $10 a day for the use of the car after she returns the car to Judy.

D) Barry pays $275 with his bank debit card for tickets for an NHL play -off game.

E) ABC Investments Inc. enters in its account books that it owes Nallai $20 for his last monthʹs investment income.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 119 of 119

Related Exams