A) current ratio.

B) debt to total assets ratio.

C) earnings per share.

D) working capital.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Two recognition principles are the fair value basis of accounting and the going concern assumption.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Using a simplified version of Canadian GAAP for small companies in order to reduce the cost of providing financial information is an example of the application of materiality.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The conceptual framework is fundamentally similar for both Canadian publicly traded companies and Canadian private companies.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If accounting information has relevance, it:

A) is not required to be complete

B) will not have predictive value.

C) will only make a difference for internal stakeholders.

D) will make a difference in users' decisions.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not normally a current liability?

A) Salaries payable

B) Accounts payable

C) Income tax payable

D) Bonds payable

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not considered a measure of liquidity?

A) Current ratio

B) Working capital

C) Both current ratio and working capital

D) Debt to total assets

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Investors are usually most interested in evaluating:

A) liquidity and solvency.

B) solvency and marketability.

C) liquidity and profitability.

D) profitability and solvency.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a financial statement element?

A) Liabilities

B) Equity

C) Expenses

D) Fair value

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A useful measure of solvency is the:

A) current ratio.

B) price-earnings ratio.

C) earnings per share.

D) debt to total assets.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Trademarks would appear in which section of the statement of financial position?

A) Shareholders' equity

B) Investments

C) Intangible assets

D) Current assets

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A short-term creditor is primarily interested in the __________ of the borrower.

A) liquidity

B) profitability

C) comparability

D) solvency

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Listing assets and liabilities in reverse order of liquidity is not permitted in Canada.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Solvency ratios measure the short-term ability of the company to pay its maturing obligations.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Liquidity ratios are concerned with the frequency and amounts of dividend payments.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Office equipment is classified on the statement of financial position as:

A) a current asset.

B) property, plant, and equipment.

C) shareholders' equity.

D) a long-term investment.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The two qualitative characteristics that are defined in terms of what influences or makes a difference to a decision maker are:

A) faithful representation and materiality.

B) comparability and timeliness

C) materiality and relevance.

D) relevance and understandability

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The investment classification on the statement of financial position normally includes investments that are intended to be held for a short period of time (less than one year).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Special rights and privileges that provide a future economic benefit to the company are classified as intangible assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

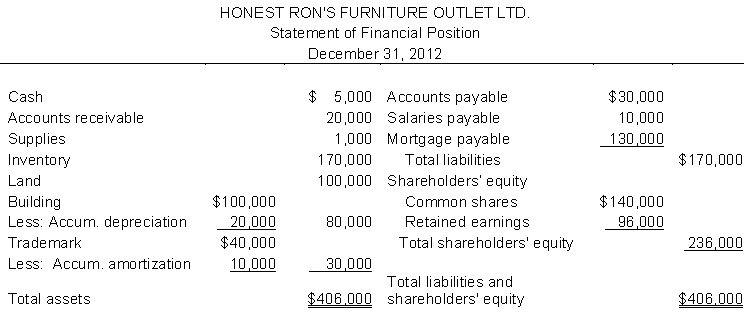

Use the following information to answer questions :  -The dollar amount of current assets is:

-The dollar amount of current assets is:

A) $ 26,000.

B) $ 40,000.

C) $ 25,000.

D) $196,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 149

Related Exams