A) excessive bank lending.

B) potential crises in financial markets.

C) inflation.

D) excess aggregate demand.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following predictions can be made using the growth rates associated with the equation of exchange, given that velocity is stable and that the economy moves to its potential output (YP) in the long run?

A) If the money supply grows at a faster rate than growth in YP, there will be inflation.

B) If the money supply grows at a slower rate than growth in YP, there will be a decrease in the inflation rate.

C) If the money supply grows at the same rate as growth in YP, the price level will fall and there will be deflation.

D) If the money supply grows at the same rate as growth in YP, the price level will also increase at the same rate as growth in YP,.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The Phillips phase of the inflation-unemployment cycle emerges because wages are flexible and adjust more quickly than anticipated.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The essential feature of the stagflation phase of the inflation-unemployment cycle is

A) a shift in the short run aggregate supply curve to the right.

B) changes in expectations about the price level.

C) falling unemployment and rising inflation.

D) a shift of the LRAS curve to the right.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

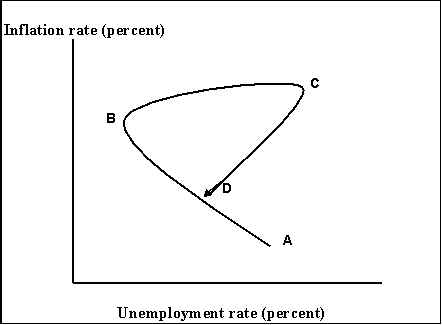

Figure 16-3

-Refer to Figure 16-3.Which of the following represents the stagflation phase?

-Refer to Figure 16-3.Which of the following represents the stagflation phase?

A) the movement from A to B

B) the movement from B to C

C) the movement from C to D

D) the movement from A to C

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The lowest wage that a worker would accept, if offered a job, is called

A) the reservation wage.

B) a subsistence wage.

C) the exploitation wage.

D) the equilibrium market wage.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In early in 1994, the Federal Reserve shifted to a contractionary policy although the economy Was still in a recessionary gap left over from the 1990-1991 recession.Which of the Following best explains this move?

A) The Fed was concerned that the budget deficit would increase.

B) The Fed had failed to take into account the lag in monetary policy.

C) The Fed was taking explicit account of the lag in monetary policy.

D) The Fed wanted to avert a potential housing market crisis.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

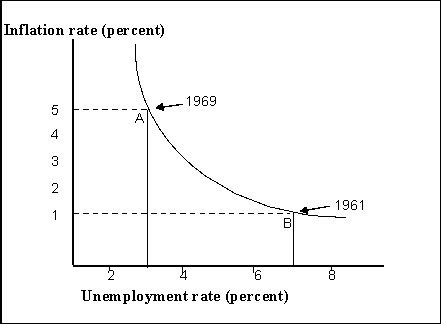

Figure 16-1

-Refer to Figure 16-1.Consider point B where unemployment is relatively high and inflation

Is relatively low.In order to move up the curve toward point A, what fiscal policy measures

Should the policymakers undertake?

-Refer to Figure 16-1.Consider point B where unemployment is relatively high and inflation

Is relatively low.In order to move up the curve toward point A, what fiscal policy measures

Should the policymakers undertake?

A) decrease taxes and government spending

B) increase taxes and government spending

C) increase taxes and decrease government spending

D) decrease taxes and increase government spending

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the following statement: "President Carter expressed concern about reports of rising inflation but insisted the economy is on the right course.He pointed to recent reductions in unemployment as evidence that his economic policies are working." Identify the stage of the inflation-unemployment cycle.

A) the stagflation phase

B) the recovery phase

C) the Phillips phase

D) the contraction phase

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the early 1970s, President Nixon inherited an economy that was operating with an inflationary gap.The Nixon administration rationalized that through a combination of a government spending cuts and a decrease in the money growth rate, it could successfully

A) reduce inflation, which would then cause unemployment to fall.

B) get the economy to slide down along the Phillips curve, thereby trading off a reduction in inflation for an increase in unemployment.

C) halt any increases in the price level by increasing productivity which would then return the economy to its potential output.

D) get the economy to slide up along the Phillips curve, thereby trading an increase in unemployment for deflation.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the inflation-unemployment cycle?

A) It refers to cyclical pattern of inflation and unemployment suggested by inflation and unemployment data for the U.S.between 1960 and 2000.

B) It refers to a recurring tradeoff between inflation and unemployment suggested by inflation and unemployment data for the U.S.between 1960 and 2000.

C) It refers to the cyclical pattern of expansions and contractions in the level of economic activity for the U.S.between 1960 and 2000.

D) It refers to the cyclical pattern of inflation-productivity and deflation-unemployment experienced by most industrialized countries.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the United States, through most of the 1990s, the unemployment rate and the inflation rate generally fell.With which phase of the inflation-unemployment cycle does this conform to?

A) Phillips phase

B) Growth phase

C) Stagflation phase

D) Recovery phase

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose an economy is operating with an inflationary gap.In this case, policymakers would Seek to move the economy

A) back down the Phillips curve toward an unemployment rate that is closer to the natural rate of unemployment.

B) up the Phillips curve toward an unemployment rate that is closer to the natural rate of unemployment.

C) back down the Phillips curve toward an unemployment rate that is further from the natural rate of unemployment.

D) up the Phillips curve toward an unemployment rate that is further from the natural rate of unemployment.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the three phases of the inflation-unemployment cycle, during the stagflation phase,

A) inflation and unemployment both increase.

B) inflation and unemployment stay the same.

C) inflation and unemployment both decrease.

D) unemployment decreases and inflation increases.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The reservation wage tends to increase as the duration of unemployment increases.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The efficiency-wage theory holds that the market equilibrium wage is the efficient wage.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the following statement: "President Nixon expressed satisfaction with last year's economic performance.He said that with inflation and unemployment heading down, the nation 'is on the right course'." Identify the stage of the inflation-unemployment cycle.

A) the stagflation phase

B) the recovery phase

C) the Phillips phase

D) the growth phase

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Since 1979 when inflation soared into the double-digit, the Federal Reserve's policies

A) have been focused on moving the economy to its potential output.

B) have clearly shown a reduced tolerance for inflation.

C) were concentrated on bringing the price of oil down.

D) have moved toward restraining growth in financial markets.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

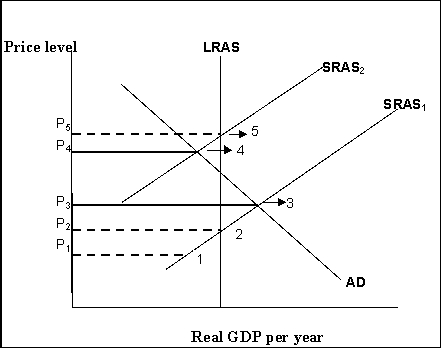

Figure 16-7

-Refer to Figure 16-7.At point 4, the economy is experiencing

-Refer to Figure 16-7.At point 4, the economy is experiencing

A) an inflationary gap.

B) a recessionary gap.

C) long-run equilibrium.

D) a recovery.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the equation of exchange, if velocity is stable in the long run, the inflation rate, (% P) Can be expressed as

A) % P = % M ÷ % Y

B) % P = % M + % Y

C) % P = % M * % Y

D) % P = % M -% Y

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 135

Related Exams