A) 1776.

B) 1812.

C) 1938.

D) 1975.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To say that a price ceiling is binding is to say that the price ceiling

A) results in a surplus.

B) is set above the equilibrium price.

C) causes quantity demanded to exceed quantity supplied.

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose sellers of liquor are required to send $5.00 to the government for every bottle of liquor they sell. Further, suppose this tax causes the price paid by buyers of liquor to rise by $3.00 per bottle. Which of the following statements is correct?

A) This tax causes the supply curve for liquor to shift upward by $5.00 at each quantity of liquor.

B) The effective price received by sellers is $5.00 per bottle less than it was before the tax.

C) Forty percent of the burden of the tax falls on buyers.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a price ceiling is a binding constraint on a market, then

A) the equilibrium price must be below the price ceiling.

B) the quantity supplied must exceed the quantity demanded.

C) sellers cannot sell all they want to sell at the price ceiling.

D) buyers cannot buy all they want to buy at the price ceiling.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

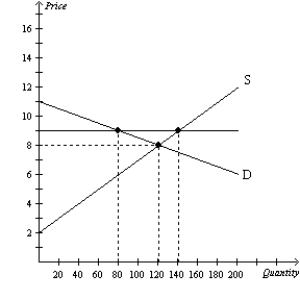

Figure 6-5  -Refer to Figure 6-5. If the solid horizontal line on the graph represents a price floor, then the price floor is

-Refer to Figure 6-5. If the solid horizontal line on the graph represents a price floor, then the price floor is

A) binding and creates a surplus of 60 units of the good.

B) binding and creates a surplus of 20 units of the good.

C) binding and creates a surplus of 40 units of the good.

D) not binding, and there will be no surplus or shortage of the good.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

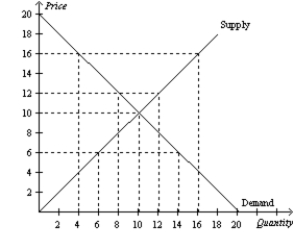

Figure 6-4  -Refer to Figure 6-4. A government-imposed price floor of $12 in this market results in

-Refer to Figure 6-4. A government-imposed price floor of $12 in this market results in

A) a surplus of 2 units.

B) a surplus of 4 units.

C) 12 units sold.

D) 10 units sold.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The tax incidence

A) is the manner in which the burden of a tax is shared among participants in a market.

B) can be shifted to the buyer by imposing the tax on the buyers of a product in a market.

C) can be shifted to the seller by imposing the tax on the sellers of a product in a market.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the most likely explanation for the imposition of a price floor on the market for corn?

A) Policymakers have studied the effects of the price floor carefully, and they recognize that the price floor is advantageous for society as a whole.

B) Buyers and sellers of corn have agreed that the price floor is good for both of them and have therefore pressured policy makers into imposing the price floor.

C) Buyers of corn, recognizing that the price floor is good for them, have pressured policymakers into imposing the price floor.

D) Sellers of corn, recognizing that the price floor is good for them, have pressured policymakers into imposing the price floor.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a binding price floor is imposed on a market,

A) price no longer serves as a rationing device.

B) the quantity demanded at the price floor exceeds the quantity that would have been demanded without the price floor.

C) all sellers benefit.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the equilibrium price of a tube of toothpaste is $2, and the government imposes a price floor of $3 per tube. As a result of the price floor,

A) quantity demanded decreases.

B) quantity supplied increases.

C) there is a surplus.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Workers determine the supply of labor, and firms determine the demand for labor.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

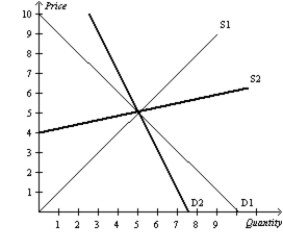

Figure 6-29

Suppose the government imposes a $2 on this market.  -Refer to Figure 6-29. Suppose D1 represents the demand curve for gasoline in both the short run and long run, S1 represents the supply curve for gasoline in the short run, and S2 represents the supply curve for gasoline in the long run. After the imposition of the $2, the price paid by buyers will be

-Refer to Figure 6-29. Suppose D1 represents the demand curve for gasoline in both the short run and long run, S1 represents the supply curve for gasoline in the short run, and S2 represents the supply curve for gasoline in the long run. After the imposition of the $2, the price paid by buyers will be

A) higher in the long run than in the short run.

B) higher in the short run than in the long run.

C) equivalent in the short run and the long run.

D) unable to be determined without additional information.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A binding price ceiling causes a shortage in the market.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

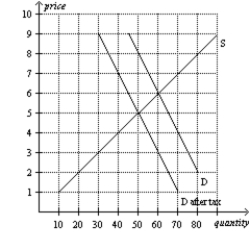

Figure 6-25  -Refer to Figure 6-25. How much tax revenue does this tax generate for the government?

-Refer to Figure 6-25. How much tax revenue does this tax generate for the government?

A) $150

B) $180

C) $250

D) $300

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Minimum-wage laws dictate

A) the exact wage that firms must pay workers.

B) a maximum wage that firms may pay workers.

C) a minimum wage that firms may pay workers.

D) both a minimum wage and a maximum wage that firms may pay workers.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following was not a result of the luxury tax imposed by Congress in 1990?

A) The larger part of the tax burden fell on sellers.

B) A larger part of the tax burden fell on the middle class than on the rich.

C) Even the wealthy demanded fewer luxury goods.

D) The tax was never repealed or even modified.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The minimum wage was instituted to ensure workers

A) a middle-class standard of living.

B) employment.

C) a minimally adequate standard of living.

D) unemployment compensation.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on buyers will shift the

A) demand curve upward by the amount of the tax.

B) demand curve downward by the amount of the tax.

C) supply curve upward by the amount of the tax.

D) supply curve downward by the amount of the tax.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Studies of the effects of the minimum wage typically find that a 10 percent increase in the minimum wage depresses teenage employment by about

A) 1 to 3 percent.

B) 5 to 7 percent.

C) 10 percent.

D) None of the above is correct because studies show no decrease in teenage employment.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

When the government imposes a binding price ceiling on a competitive market, a surplus of the good arises, and sellers must ration the scarce goods among the large number of potential buyers.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 601 - 620 of 668

Related Exams