A) The capital structure that maximizes the stock price is also the capital structure that minimizes the weighted average cost of

Capital (WACC) .

B) The capital structure that maximizes the stock price is also the

Capital structure that maximizes earnings per share.

C) The capital structure that maximizes the stock price is also the capital structure that maximizes the firm's times interest earned

(TIE) ratio.

D) Increasing a company's debt ratio will typically reduce the marginal costs of both debt and equity financing; however, this

Still may raise the company's WACC.

E) If Congress were to pass legislation that increases the personal tax rate but decreases the corporate tax rate, this would encourage

Companies to increase their debt ratios.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Volga Publishing is considering a proposed increase in its debt ratio, which would also increase the company's interest expense. The plan would involve issuing new bonds and using the proceeds to buy back shares of its common stock. The company's CFO thinks the plan will not change total assets or operating income, but that it will increase earnings per share (EPS) . Assuming the CFO's estimates are correct, which of the following statements is CORRECT?

A) Since the proposed plan increases Volga's financial risk, the company's stock price still might fall even if EPS increases.

B) If the plan reduces the WACC, the stock price is also likely to

Decline.

C) Since the plan is expected to increase EPS, this implies that net

Income is also expected to increase.

D) If the plan does increase the EPS, the stock price will

Automatically increase at the same rate.

E) Under the plan there will be more bonds outstanding, and that will increase their liquidity and thus lower the interest rate on the

Currently outstanding bonds.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is AJC's current total market value and weighted average cost of capital?

A) $600,000; 7.5%

B) $600,000; 8.0%

C) $800,000; 7.0%

D) $800,000; 7.5%

E) $800,000; 8.0%

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Simon Software Co. is trying to estimate its optimal capital structure. Right now, Simon has a capital structure that consists of 20% debt and 80% equity, based on market values. (Its D/S ratio is 0.25.) The risk- free rate is 6% and the market risk premium, rM - rRF, is 5%. Currently the company's cost of equity, which is based on the CAPM, is 12% and its tax rate is 40%. What would be Simon's estimated cost of equity if it were to change its capital structure to 50% debt and 50% equity?

A) 13.00%

B) 13.64%

C) 14.35%

D) 14.72%

E) 15.60%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) In general, a firm with low operating leverage also has a small proportion of its total costs in the form of fixed costs.

B) There is no reason to think that changes in the personal tax rate

Would affect firms' capital structure decisions.

C) A firm with high business risk is more likely to increase its use of financial leverage than a firm with low business risk, assuming

All else equal.

D) If a firm's after-tax cost of equity exceeds its after-tax cost of

Debt, it can always reduce its WACC by increasing its use of debt.

E) Suppose a firm has less than its optimal amount of debt. Increasing its use of debt to the point where it is at its optimal capital

Structure will decrease the costs of both debt and equity financing.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Reynolds Resorts is currently 100% equity financed. The CFO is considering a recapitalization plan under which the firm would issue long-term debt with a yield of 9% and use the proceeds to repurchase common stock. The recapitalization would not change the company's total assets, nor would it affect the firm's basic earning power, which is currently 15%. The CFO believes that this recapitalization would reduce the WACC and increase stock price. Which of the following would also be likely to occur if the company goes ahead with the recapitalization plan?

A) The company's net income would increase.

B) The company's earnings per share would decline.

C) The company's cost of equity would increase.

D) The company's ROA would increase.

E) The company's ROE would decline.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

It is possible that two firms could have identical financial and operating leverage, yet have different degrees of risk as measured by the variability of EPS.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm utilizes debt financing, an X% decline in earnings before interest and taxes (EBIT) will result in a decline in earnings per share that is larger than X.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Now assume that BB is considering changing from its original capital structure to a new capital structure with 45% debt and 55% equity. This results in a weighted average cost of capital equal to 10.4% and a new value of operations of $576,923. Assume BB raises $259,615 in new debt and purchases T-bills to hold until it makes the stock repurchase. What is the stock price per share immediately after issuing the debt but prior to the repurchase?

A) $14.42

B) $19.36

C) $23.91

D) $28.85

E) $35.62

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on the information below, what is Ezzel Enterprises' optimal capital structure?

A) Debt = 40%; Equity = 60%; EPS = $2.95; Stock price = $26.50.

B) Debt = 50%; Equity = 50%; EPS = $3.05; Stock price = $28.90.

C) Debt = 60%; Equity = 40%; EPS = $3.18; Stock price = $31.20.

D) Debt = 80%; Equity = 20%; EPS = $3.42; Stock price = $30.40.

E) Debt = 70%; Equity = 30%; EPS = $3.31; Stock price = $30.00.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies HD and LD have the same total assets, operating income (EBIT) , tax rate, and business risk. Company HD, however, has a much higher debt ratio than LD. Also HD's basic earning power (BEP) exceeds its cost of debt (rd) . Which of the following statements is CORRECT?

A) HD should have a higher return on assets (ROA) than LD.

B) HD should have a higher times interest earned (TIE) ratio than LD.

C) HD should have a higher return on equity (ROE) than LD, but its risk, as measured by the standard deviation of ROE, should also be

Higher than LD's.

D) Given that BEP > rd, HD's stock price must exceed that of LD.

E) Given that BEP > rd, LD's stock price must exceed that of HD.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lauterbach Corporation uses no debt, its beta is 1.10, and its tax rate is 40%. However, the CFO is considering moving to a capital structure with 30% debt and 70% equity. If the risk-free rate is 5.0% and the market risk premium is 6.0%, by how much would the capital structure shift change the firm's cost of equity?

A) 1.53%

B) 1.70%

C) 1.87%

D) 2.05%

E) 2.26%

G) None of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

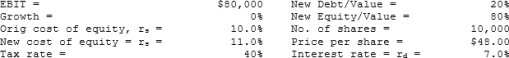

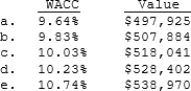

(The following data apply to Problems 63, 64, and 65. The problems MUST be kept together.)

Volunteer Fabricators, Inc. (VF) currently has zero debt. It is a zero growth company, and it has the data shown below. Now the company is considering using some debt, moving to the market value capital structure indicated below. The money raised would be used to repurchase stock. It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise somewhat, as indicated below.

-If this plan were carried out, what would be VF's new WACC and its new value of operations?

-If this plan were carried out, what would be VF's new WACC and its new value of operations?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(The following data apply to Problems 60, 61, and 62. The problems MUST be kept together, and they cannot be changed algorithmically.) Powell Plastics, Inc. (PP) currently has zero debt. Its earnings before interest and taxes (EBIT) are $80,000, and it is a zero growth company. PP's current cost of equity is 10%, and its tax rate is 40%. The firm has 10,000 shares of common stock outstanding selling at a price per share of $48.00. -Assume that PP is considering changing from its original capital structure to a new capital structure with 35% debt and 65% equity. This results in a weighted average cost of capital equal to 9.4% and a new value of operations of $510,638. Assume PP raises $178,723 in new debt and purchases T-bills to hold until it makes the stock repurchase. PP then sells the T-bills and uses the proceeds to repurchase stock. How many shares remain after the repurchase, and what is the stock price per share immediately after the repurchase?

A) 7,500;

$71) 49

B) 7,000;

$59) 57

C) 6,500;

$51) 06

D) 6,649;

$53) 33

E) 6,959;

$58) 78

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following events is likely to encourage a company to raise its target debt ratio, other things held constant?

A) An increase in the corporate tax rate.

B) An increase in the personal tax rate.

C) An increase in the company's operating leverage.

D) The Federal Reserve tightens interest rates in an effort to fight

Inflation.

E) The company's stock price hits a new high.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

As the text indicates, a firm's financial risk has identifiable market risk and diversifiable risk components.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Congress Company has identified two methods for producing playing cards. One method involves using a machine having a fixed cost of $10,000 and variable costs of $1.00 per deck of cards. The other method would use a less expensive machine (fixed cost = $5,000) , but it would require greater variable costs ($1.50 per deck of cards) . If the selling price per deck of cards will be the same under each method, at what level of output will the two methods produce the same net operating income (EBIT) ?

A) 5,000 decks

B) 10,000 decks

C) 15,000 decks

D) 20,000 decks

E) 25,000 decks

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If debt financing is used, which of the following is CORRECT?

A) The percentage change in net operating income will be greater than a given percentage change in net income.

B) The percentage change in net operating income will be equal to a

Given percentage change in net income.

C) The percentage change in net income relative to the percentage change in net operating income will depend on the interest rate

Charged on debt.

D) The percentage change in net income will be greater than the

Percentage change in net operating income.

E) The percentage change in sales will be greater than the percentage change in EBIT, which in turn will be greater than the percentage change in net income.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stephens Electronics is considering a change in its target capital structure, which currently consists of 25% debt and 75% equity. The CFO believes the firm should use more debt, but the CEO is reluctant to increase the debt ratio. The risk-free rate, rRF, is 5.0%, the market risk premium, RPM, is 6.0%, and the firm's tax rate is 40%. Currently, the cost of equity, rs, is 11.5% as determined by the CAPM. What would be the estimated cost of equity if the firm used 60% debt? (Hint: You must first find the current beta and then the unlevered beta to solve the problem.)

A) 10.95%

B) 11.91%

C) 12.94%

D) 14.07%

E) 15.29%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A firm's business risk is largely determined by the financial characteristics of its industry, especially by the amount of debt the average firm in the industry uses.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 70

Related Exams