A) $25,000

B) $50,000

C) $200,000

D) $250,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economic surplus

A) does not exist when a competitive market is in equilibrium.

B) is equal to the sum of consumer surplus and producer surplus.

C) is the difference between quantity demanded and quantity supplied when the market price for a product is greater than the equilibrium price.

D) is equal to the difference between consumer surplus and producer surplus.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a consequence of minimum wage laws?

A) Low-skilled workers are hurt because minimum wage reduces the number of jobs providing low-skilled workers with training.

B) Employers will be reluctant to offer low-skilled workers jobs with training.

C) Producers have an incentive to offer workers non-wage benefits such as health care benefits and convenient working hours rather than a higher wage.

D) Some workers benefit when the minimum wage is increased.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

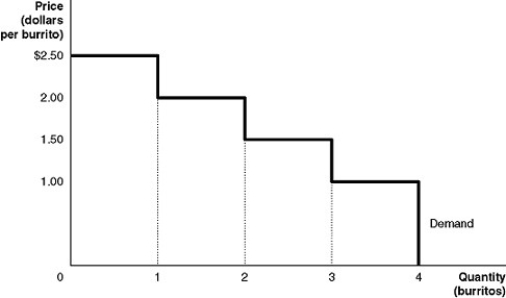

Figure 4-1

Figure 4-1 shows Arnold's demand curve for burritos.

-Refer to Figure 4-1.What is the total amount that Arnold is willing to pay for 2 burritos?

Figure 4-1 shows Arnold's demand curve for burritos.

-Refer to Figure 4-1.What is the total amount that Arnold is willing to pay for 2 burritos?

A) $2.00

B) $4.50

C) $7.50

D) $10.00

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When Congress passed a law that imposed a tax designed to fund its Social Security and Medicare programs, it wanted employers and workers to share the burden of the tax equally.Most economists who have studied the incidence of the tax have concluded

A) the tax is not high enough to cover the future costs of Social Security and Medicare.

B) the tax on employers is too high because it reduces the employment of low-skilled workers.

C) the burden of the tax falls almost entirely on workers.

D) the tax rate should be greater for high-income workers than for low-income workers.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rent control is an example of

A) a subsidy for low-skilled workers.

B) a price floor.

C) a price ceiling.

D) a black market.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

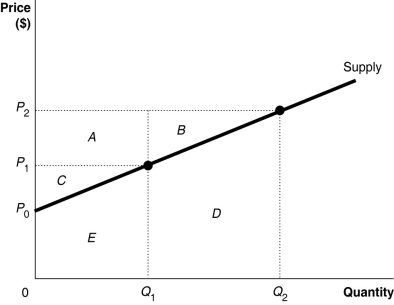

Figure 4-2

-Refer to Figure 4-2.What area represents the increase in producer surplus when the market price rises from P₁ to P₂?

-Refer to Figure 4-2.What area represents the increase in producer surplus when the market price rises from P₁ to P₂?

A) B + D

B) A + C + E

C) C + E

D) A + B

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax that imposes a small excess burden relative to the tax revenue that it raises is

A) a payroll tax.

B) a sin tax.

C) an efficient tax.

D) a FICA tax.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 201 - 208 of 208

Related Exams