B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A debt-payments-to-disposable-income ratio with monthly nonmortgage debt repayments of $470 and a disposable income of $3,615 would be ____ percent.

A) 13

B) 20

C) 8

D) 87

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A cash-flow statement summarizes transactions that have taken place over a specific period of time.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Financial plans should include objectives and goals in which of the following areas?

A) Spending

B) Risk management

C) Capital accumulation

D) All of these

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

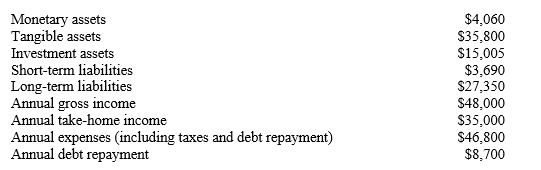

NARRBEGIN: Figure 3-1

Figure 3-1

Maria and John Sanchez have just completed their third annual set of financial statements.They met in a personal finance class while in college and still remember their instructor's advice regarding the importance of knowing their financial condition and progress.Even before they got married,they decided that each year on February 2 (Groundhog Day) they would update their cash-flow statement and their balance sheet.

The following information is taken from their latest financial statements:

-A long-term goal is one that is projected to be achieved beyond how much time?

-A long-term goal is one that is projected to be achieved beyond how much time?

A) six months

B) one year

C) five year

D) ten years

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The three broad areas of financial plans include financial plans for

A) spending.

B) risk management.

C) capital accumulation.

D) All of these.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A low asset-to-debt ratio is a positive indicator of financial well-being.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Financial planning focuses primarily on spending wisely.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A person is insolvent when he or she doesn't have enough current income to pay all of his or her current bills.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Discretionary income is used to pay for things like

A) auto loans.

B) food.

C) rent.

D) insurance.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A surplus on your cash-flow statement indicates that you are

A) using savings to pay current expenses.

B) managing your financial resources successfully.

C) borrowing money to pay current expenses.

D) both using savings to pay current expenses and borrowing money to pay current expenses.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vincent and Paula Farelli have decided to pay off their $875 MasterCard debt by taking $875 out of their money market savings account.This transaction will

A) increase their net worth on their balance sheet.

B) not change their net worth on their balance sheet.

C) decrease the surplus on their income and expense statement.

D) not change the surplus on their income and expense statement.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

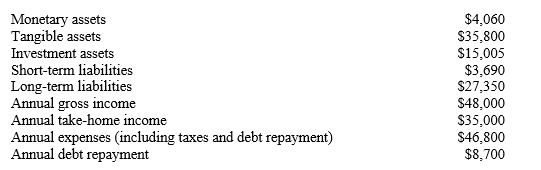

NARRBEGIN: Figure 3-1

Figure 3-1

Maria and John Sanchez have just completed their third annual set of financial statements.They met in a personal finance class while in college and still remember their instructor's advice regarding the importance of knowing their financial condition and progress.Even before they got married,they decided that each year on February 2 (Groundhog Day) they would update their cash-flow statement and their balance sheet.

The following information is taken from their latest financial statements:

-A short-term goal is one that is projected to be achieved within how much time?

-A short-term goal is one that is projected to be achieved within how much time?

A) one month

B) three months

C) one year

D) five years

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Ronselli family has total assets of $460,000 and total liabilities of $186,000.Included in their total assets are monetary assets of $47,000 and investment assets of $253,000.What is the Ronsellis' investment assets-to-total assets ratio?

A) 26 percent

B) 55 percent

C) 65 percent

D) 92 percent

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The primary purpose of setting long-term financial goals is to help

A) measure financial success or failure.

B) provide direction for overall financial planning.

C) acquire great wealth.

D) achieve a comfortable retirement.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Short-term liabilities are obligations to be paid off within one year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A family with two income earners will always need a greater amount of cash reserves than a family with one earner.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is (are) characteristic of a safe-deposit box?

A) Customer keeps all keys

B) Takes two keys to open

C) Come without an annual fee

D) They are not secure

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The advantages of having organized financial records include

A) helping you save money as well as make money.

B) helping you take advantage of all available tax deductions.

C) enabling you to review the results of financial transactions.

D) all of these.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A surplus demonstrates that you are managing your financial resources successfully and do not have to use savings or borrow to make financial ends meet.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 151

Related Exams