A) $15,573

B) $800

C) $9,500

D) $15,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Support department fixed costs are allocated on the basis of original capacity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

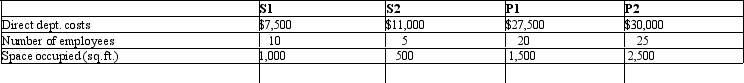

Evergreen Company has two support departments (S1 and S2) and two producing departments (P1 and P2) . Department S1 costs are allocated on the basis of number of employees, and Department S2 costs are allocated on the basis of space occupied expressed in square feet. Data on direct department costs, number of employees, and space occupied are as follows:

If Evergreen uses the direct method, the ratio representing the portion of Department S2 allocated to P1 is

If Evergreen uses the direct method, the ratio representing the portion of Department S2 allocated to P1 is

A) 1,500/5,000.

B) 1,500/4,000.

C) 1,500/5,500.

D) 1,500/2,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rules of financial reporting (GAAP) require

A) that direct manufacturing costs and a fair share of indirect manufacturing costs be assigned to products.

B) that only producing department costs be assigned to products.

C) that only direct manufacturing costs be assigned to products.

D) that only indirect manufacturing costs be assigned to products.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

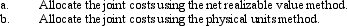

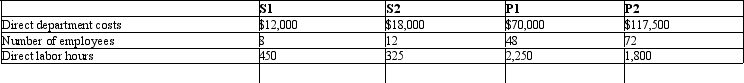

Essay

Soy Products produces two products, Soyburgers and Soy steaks, in a single process. In 2014, the joint costs of this process were $36,000. In addition, 20,000 pounds of soyburgers and 10,000 pounds of soy steaks were produced. Separable processing costs beyond the split-off point were: soyburgers, $7,500; soy steaks, $4,500. Soyburgers sells for $2 per pound; Soy steaks sells for $4 per pound.

Required:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 7-7 Garden of Eden Company manufactures two products, Brights and Dulls, from a joint process. A production run costs $50,000 and results in 250 units of Brights and 1,000 units of Dulls. Both products must be processed past the split-off point, incurring separable costs for Brights of $60 per unit and $40 per unit for Dulls. The market price is $250 for Brights and $200 for Dulls. Refer to Figure 7-7. What is the amount of joint costs allocated to Dulls using the physical units method?

A) $50,000

B) $160,000

C) $38,554

D) $40,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The choice of allocation method depends on an evaluation of costs and benefits, and circumstances.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Costs that are easily traced to individual products are called separable costs.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

__________ are mutually beneficial costs to joint product costing.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Support departments

A) are responsible for manufacturing the products sold to customers.

B) work directly on the products of the firm.

C) provide services directly to customers.

D) provide essential services to the producing departments.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

McDuff Company uses a job-order costing system to compute product costs. There are two producing departments (P1 and P2) and two support departments (S1 and S2). The costs incurred in S1 and S2 are allocated to Departments A and B and included in their factory overhead rates for costing products. S1 costs are allocated based on the number of employees, S2 costs are allocated based on direct labor hours, and the production departmental overhead rates are also based on direct labor hours. The following data are available for a recent period:

Required:

Required:

Correct Answer

verified

Correct Answer

verified

Short Answer

The __________ method of allocating costs, allocates costs from support to producing departments.

Correct Answer

verified

Correct Answer

verified

True/False

The split-off point is the ending point of a joint product process.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the allocation is for product costing, the allocation of variable support department costs would be calculated as

A) Actual rate ´ Actual usage.

B) Actual rate ´ Budgeted usage.

C) Budgeted rate ´ Actual usage.

D) Budgeted rate ´ Budgeted usage.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Producing departments provide essential services for support departments.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

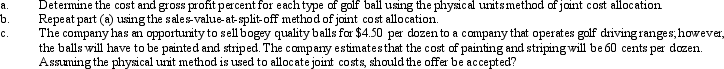

Henderson Company pays a flat fee of $500 for the right to retrieve stray golf balls from lakes and ponds at golf and country clubs. The recovered balls are then cleaned, graded as to quality (birdie, bogey, or duffer), and sold to sporting goods stores at the following prices per dozen: birdie quality, $5; bogey quality, $4; and duffer quality, $3. Last month $8,000 of cost was incurred retrieving the following quantities of golf balls: birdie quality, 1,000 dozen; bogey quality, 3,000 dozen; and duffer quality, 2,000 dozen.

Required: (Calculate relative quantity to three decimal points.)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deli Products produces two products, X and Y, in a single process. In 2011, the joint costs of this process were $25,000. In addition, 4,000 units of X and 6,000 units of Y were produced and sold. Separable processing costs beyond the split-off point were: X - $10,000; Y - $20,000. X sells for $10.00 per unit; Y sells for $7.50 per unit. What is the gross profit of product Y assuming the physical units method is used?

A) $25,000

B) $-0-

C) $10,000

D) $15,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Andover, Inc., has two producing departments. Each producing department is held responsible for a share of the costs of a support department. Actual and budgeted data are as follows:

Normal support department usage is 8,000 hours each for Department X and Department Y. Assuming the direct method is used and the purpose is performance evaluation, support department costs allocated to Department X are

Normal support department usage is 8,000 hours each for Department X and Department Y. Assuming the direct method is used and the purpose is performance evaluation, support department costs allocated to Department X are

A) $45,000.

B) $36,400.

C) $40,000.

D) $36,000.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Vladimir, Inc. began the current period with no inventories. During the period, it processed 50,000 pounds of materials costing $450,000. Conversion costs incurred during the period amounted to $660,000. The firm ended the period with no work-in-process. During the period, the firm produced 16,000, 24,000, and 10,000 units of X, Y, and Z, respectively. All costs are considered joint costs. The firm sold 12,000 units of X, 16,000 units of Y, and 9,000 units of Z. X sells for $30 per unit, Y for $44 per unit, and Z for $4 per unit. The firm uses the net realizable value method for cost allocation. Z is considered a by-product.

Required:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The activities or variables within a producing department that provoke the incurrence of support costs are called:

A) Causal factors

B) Common costs

C) Cost objectives

D) Activity output

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 173

Related Exams