A) $30,000 and $150,000

B) $50,000 and $250,000

C) $50,000 and $500,000

D) $100,000 and $500,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a bank grants a loan to a customer who gets the funds and keeps it at home for a while, then the money supply will:

A) Not change because demand deposits did not go up

B) Not change because the money was not spent

C) Increase

D) Decrease

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If banks borrow from the Fed, the banking system's reserves will increase, but if banks borrow from one another, the banking system's reserves will not change.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The fractional reserve system of banking started when goldsmiths began:

A) Accepting deposits of gold for safe storage

B) Charging people who deposited their gold

C) Using deposited gold to produce products for sale to others

D) Issuing paper receipts in excess of the amount of gold held

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The commercial banking system, because of a recent change in the required reserve ratio from 8 percent to 10 percent, finds that it is $50 million short of reserves. If it is unable to obtain any additional reserves, it must reduce deposits and money supply by:

A) $250 million

B) $625 million

C) $500 million

D) $50 million

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are liabilities to a bank?

A) Capital stock and reserves

B) Property and capital stock

C) Vault cash and demand deposits

D) Demand and time deposits

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a bank has excess reserves of $100,000, then it can lend out only up to $100,000; but if the banking system has excess reserves of $100,000, then the system can make additional loans totaling more than $100,000.

B) False

Correct Answer

verified

True

Correct Answer

verified

True/False

A check for $10,000 drawn on Bank A and deposited at Bank B will increase the excess reserves in Bank B by $10,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A commercial bank has actual reserves of $1 million and checkable-deposit liabilities of $9 million, and the required reserve ratio is 10 percent. The excess reserves of the bank are:

A) $50,000

B) $100,000

C) $900,000

D) $1 million

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The claims of creditors of a bank against the bank's assets are called:

A) Loans

B) Net worth

C) Liabilities

D) Required reserves

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A commercial bank's checkable-deposit liabilities can be estimated by:

A) Dividing its required reserves by its excess reserves

B) Dividing its required reserves by the reserve ratio

C) Multiplying its required reserves by its excess reserves

D) Multiplying its required reserves by the reserve ratio

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things being equal, an expansion of commercial bank lending:

A) Changes the composition, but not the size, of the money supply

B) Is desirable during a period of demand-pull inflation

C) Reduces the money supply

D) Increases the money supply

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The primary purpose of the reserve requirements for banks is not really to ensure liquidity to meet withdrawals, but rather to allow the Fed some control over the money supply.

B) False

Correct Answer

verified

True

Correct Answer

verified

True/False

When a bank buys government securities from the Fed, then the bank's ability to "create money" will be reduced.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A checkable deposit at a commercial bank is a(n) :

A) Liability to the depositor and an asset to the bank

B) Liability to both the depositor and the bank

C) Asset to the depositor and a liability to the bank

D) Asset to both the depositor and the bank

F) All of the above

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

The fact that reserves lost by any particular bank will be gained by some other bank explains why the commercial banking system:

A) Has been able to reduce the vulnerability of banks to "runs" or "panics"

B) Can increase its demand deposits by a multiple of its excess reserves

C) Cannot increase its demand deposits by a multiple of its excess reserves

D) Has been based on the fractional reserve system of banking

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

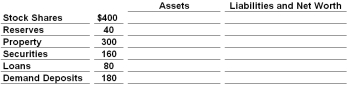

The figures in the table below are for a single commercial bank. All figures are in thousands of dollars.  Refer to the data given above. This bank has total assets of:

Refer to the data given above. This bank has total assets of:

A) $340 million

B) $440 million

C) $520 million

D) $580 million

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A commercial bank buys a $50,000 government security from a securities dealer. The bank pays the dealer by increasing the dealer's checkable deposit balance by $50,000. The money supply has:

A) Not been affected

B) Decreased by $50,000

C) Increased by $50,000

D) Increased by $50,000 multiplied by the reserve ratio

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When cash is withdrawn from a checkable-deposit account at a bank:

A) The money supply M1 increases

B) The money supply M1 decreases

C) The money supply M1 does not change but its composition changes

D) The composition of money supply M1 does not change

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A bank has reserves of $30,000 and deposits of $120,000. If the reserve ratio is 10%, then this bank can lend out a maximum of $12,000 in new loans.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 127

Related Exams