A) Decreased by $10,000 multiplied by the reciprocal of the required reserve ratio

B) Decreased by $10,000

C) Increased by $10,000

D) Not been affected

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A depositor places $10,000 in cash in a commercial bank, where the required reserve ratio is 10 percent. The bank sends the $10,000 to its Federal Reserve Bank. As a result, the actual reserves, required reserves, and excess reserves of the bank have been increased by:

A) $10,000, $9000, and $1000 respectively

B) $10,000, $500, and $4500 respectively

C) $10,000, $1000, and $9000 respectively

D) $1000, $10,000, and $9000 respectively

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a check is cleared against a bank, the bank will lose:

A) Cash and securities

B) Checkable deposits and reserves

C) Reserves and capital stock

D) Loans and demand deposits

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a commercial banking system has $240,000 of outstanding checkable deposits and actual reserves of $85,000. If the reserve ratio is 25 percent, the banking system can expand the supply of money by a maximum of:

A) $75,000

B) $25,000

C) $5,000

D) $100,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bank can get additional excess reserves by doing any of the following, except:

A) Borrowing from other banks

B) Buying Treasury securities from the Fed

C) Receiving additional deposits

D) Borrowing from the Fed

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the reserve ratio is 25 percent, what level of excess reserves does a bank acquire when a customer deposits a $12,000 check drawn on another bank?

A) $3,000

B) $6,000

C) $9,000

D) $12,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The basic purpose of imposing legal reserve requirements on commercial banks is to:

A) Assure the liquidity of commercial banks

B) Provide a device through which the credit-creating activities of banks can be controlled

C) Provide a proper ratio between earning and no earning bank assets

D) Provide the central banks with necessary working capital

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the required reserve ratio is 20 percent and commercial bankers decide to hold additional excess reserves equal to 5 percent of any newly acquired checkable deposits, then the effective monetary multiplier for the banking system will be:

A) 3

B) 4

C) 5

D) 6

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A commercial bank has no excess reserves until a depositor places $5000 in cash at the bank. The commercial bank then lends $4000 to a borrower. As a consequence of these transactions the size of the money supply has:

A) Not been affected

B) Increased by $4000

C) Increased by $5000

D) Decreased by $5000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

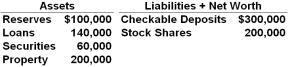

Answer the question based on the following consolidated balance sheet for the commercial banking system. Assume the required reserve ratio is 12 percent. All figures are in billions of dollars:  Refer to the above data. The maximum amount by which the commercial banking system can expand the supply of money by lending is:

Refer to the above data. The maximum amount by which the commercial banking system can expand the supply of money by lending is:

A) $250 billion

B) $350 billion

C) $450 billion

D) $600 billion

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Money is "created" when:

A) A depositor gets cash from the bank's ATM

B) A bank accepts deposits from its customers

C) People receive loans from their banks

D) People spend the incomes that they receive

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If all depositors of a bank were to try withdrawing all their deposits at the same time, a good solid bank should be able to meet all the withdrawals.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

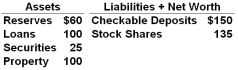

The figures in the table below are for a single commercial bank. All figures are in thousands of dollars.  Refer to the data given above. If the reserve ratio is 10 percent and a check for $10,000 is drawn and cleared in favor of another bank, then the actual reserves of the bank above will:

Refer to the data given above. If the reserve ratio is 10 percent and a check for $10,000 is drawn and cleared in favor of another bank, then the actual reserves of the bank above will:

A) Still be $40,000

B) Decrease $10,000

C) Decrease $11,000

D) Decrease $9,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The relative importance of various asset items on a commercial bank's balance sheet reflects a bank's pursuit of which two conflicting goals?

A) Profits and risk

B) Liquidity and profits

C) Assets and liabilities

D) Buying and selling government securities

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A depositor places $5,000 in cash in a commercial bank, and the reserve ratio is 20 percent; the bank sends the $5,000 to the Federal Reserve Bank. As a result, the reserves and excess reserves of the bank have been increased, respectively, by:

A) $5,000 and $1,000

B) $5,000 and $4,000

C) $5,000 and $5,000

D) $4,000 and $4,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The maximum deposit creation that can be made in the banking system is equal to the excess reserves divided by the required reserve ratio.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a bank grants a loan to a customer who then keeps the funds in her checking account at that bank, then the bank's:

A) Actual reserves will increase

B) Required reserves will increase

C) Actual reserves will decrease

D) Excess reserves will stay the same

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What percent of the money that a typical modern bank invests comes from borrowing?

A) About 50%

B) About 33%

C) About 75%

D) About 95%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Only one commercial bank in the banking system has an excess reserve, and its excess reserve is $400,000. This bank makes a new loan of $300,000 and keeps an excess reserve of $100,000. If the required reserve ratio for all banks is 12.5 percent, the potential expansion of the money supply from this new loan is:

A) $37,500

B) $300,000

C) $2.4 million

D) $3.2 million

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

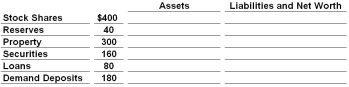

The balance sheet below is for the First Federal Bank. Assume the required reserve ratio is 20 percent.  Refer to the above information. If the original bank balance sheet was for the whole commercial banking system rather than a single bank, loans and deposits could have been expanded by a maximum of:

Refer to the above information. If the original bank balance sheet was for the whole commercial banking system rather than a single bank, loans and deposits could have been expanded by a maximum of:

A) $40,000

B) $100,000

C) $200,000

D) $300,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 127

Related Exams