A) is highly unlikely if the Phillips curve is downward sloping.

B) implies that a tradeoff between inflation and unemployment may not always exist.

C) is the simultaneous occurrence of high rates of inflation and unemployment.

D) b and c

E) a,b,and c

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

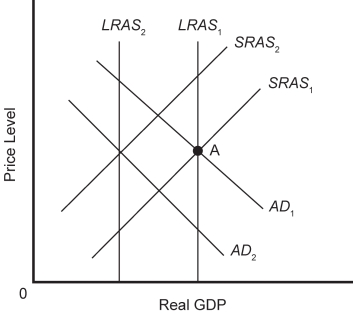

Exhibit 16-4  -Refer to Exhibit 16-4.If LRAS1 shifts to LRAS2,and this causes AD1 to shift to AD2,economists would call this a

-Refer to Exhibit 16-4.If LRAS1 shifts to LRAS2,and this causes AD1 to shift to AD2,economists would call this a

A) rational expectations cycle.

B) policy ineffectiveness proposition.

C) short run Phillips curve.

D) real business cycle.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Milton Friedman argued that there is a

A) permanent downward-sloping Phillips curve.

B) temporary downward-sloping Phillips curve.

C) temporary upward-sloping Phillips curve.

D) permanent upward-sloping Phillips curve.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If there is a stable downward-sloping Phillips curve,it follows that an economy can choose the combination of

A) high unemployment and low inflation.

B) low unemployment and high inflation.

C) moderate unemployment and moderate inflation.

D) low inflation and low unemployment.

E) a,b,and c

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following changes would not be considered a likely source of changes in Real GDP according to real business cycle theory?

A) a natural disaster

B) a technological change

C) a change in the price of an important input

D) a change in the money supply

E) none of the above

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The main difference between new classical and new Keynesian theory is with respect to the assumption of

A) how expectations are formed.

B) how flexible wages and prices are.

C) the slope of the SRAS curve.

D) the slope of the AD curve.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

New Keynesian theorists argue that

A) price and wage adjustments in response to policy changes often overcompensate and cause further price disruptions.

B) prices and wages may not be free to adjust in response to policy changes.

C) unions and big business have considerable power and often choose not to change wages and prices so as to deliberately offset policy changes enacted by the government.

D) the Fed and the Congress rarely do what they say they will do,so one should never listen to what they say.

E) new classical rational expectations theories about how expectations are formed are completely wrong.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

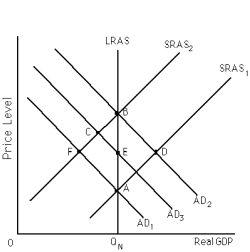

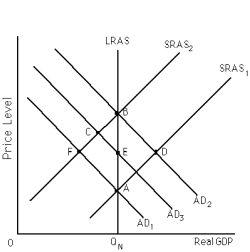

Exhibit 16-2  -Refer to Exhibit 16-2.Suppose the economy starts at point B.Fed monetary policy shifts the AD curve to AD1.If policy is correctly anticipated and people hold rational expectations,according to new classical theory the economy in the short run will

-Refer to Exhibit 16-2.Suppose the economy starts at point B.Fed monetary policy shifts the AD curve to AD1.If policy is correctly anticipated and people hold rational expectations,according to new classical theory the economy in the short run will

A) move to A.

B) stay at B.

C) move to F.

D) move to E.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

According to new classical theory,if policy is correctly anticipated,expectations are formed rationally,and wages and prices are fully flexible,then an increase in aggregate demand will change Real GDP,but not the price level.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

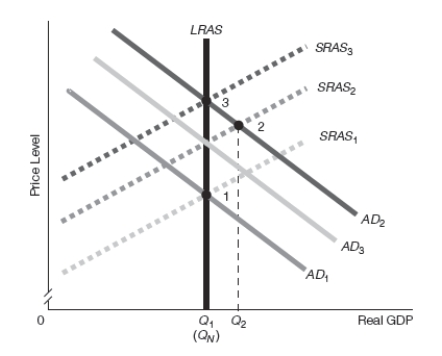

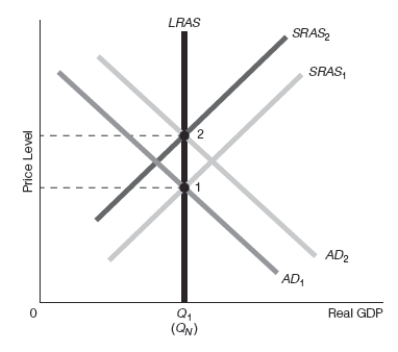

Exhibit 16-8  -Refer to Exhibit 16-8.Assume that the starting point is point 1.Suppose that the Fed implements expansionary monetary policy that raises aggregate demand.Which of the following best goes with the diagram shown?

-Refer to Exhibit 16-8.Assume that the starting point is point 1.Suppose that the Fed implements expansionary monetary policy that raises aggregate demand.Which of the following best goes with the diagram shown?

A) New classical theory with policy incorrectly anticipated,bias downward

B) New classical theory with policy incorrectly anticipated,bias upward

C) Real business cycle theory

D) New classical theory with policy unanticipated

E) Policy ineffectiveness proposition (PIP)

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

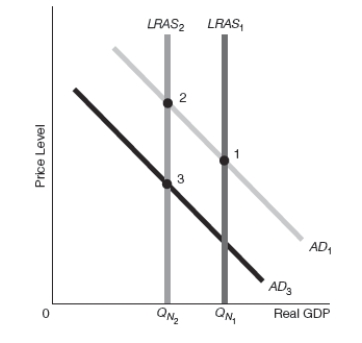

Exhibit 16-11  -Refer to Exhibit 16-11.Assume that the starting point is point 1.Suppose that there is a supply-side change capable of reducing the capacity of the economy to produce.Which of the following best goes with the diagram shown?

-Refer to Exhibit 16-11.Assume that the starting point is point 1.Suppose that there is a supply-side change capable of reducing the capacity of the economy to produce.Which of the following best goes with the diagram shown?

A) New classical theory with policy incorrectly anticipated,bias downward

B) New classical theory with policy incorrectly anticipated,bias upward

C) Real business cycle theory

D) New classical theory with policy unanticipated

E) Policy ineffectiveness proposition (PIP)

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Friedman natural rate theory is built upon

A) rational expectations.

B) adaptive expectations.

C) flexible wages and prices.

D) the assumption of one Phillips curve.

E) b and c

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to Friedman,in which of the following situations is the economy in long-run equilibrium?

A) The average inflation rate over the past five years is 2 percent and the expected inflation rate is 2 percent.

B) The expected economic growth rate is 3 percent and the actual inflation rate is 3 percent.

C) The expected economic growth rate is 2 percent and the expected inflation rate is 2 percent.

D) The expected inflation rate is 3 percent and the actual inflation rate is 3 percent.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 16-3  -Refer to Exhibit 16-3.The economy is at point A.According to the Friedman natural rate theory,in the long run after a rise in the money supply,the economy will be at point

-Refer to Exhibit 16-3.The economy is at point A.According to the Friedman natural rate theory,in the long run after a rise in the money supply,the economy will be at point

A) A.

B) B.

C) C'.

D) C.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If stagflation is present the short-run Phillips curve is vertical.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As incorrectly low inflation expectations catch up with the higher actual inflation rate,the SRAS curve shifts __________ and the short-run Phillips curve shifts __________.

A) leftward;downward

B) rightward;upward

C) leftward;upward

D) rightward;downward

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Friedman natural rate theory states that

A) in both the short run and the long run the economy stays at its natural rate of unemployment.

B) the economy will not return to its natural rate of unemployment in either the short run or the long run.

C) the economy stays at its natural rate of unemployment in the short run,but not in the long run.

D) in the long run the economy returns to its natural rate of unemployment.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 16-10  -Refer to Exhibit 16-10.Assume that the starting point is point 1.Suppose that the government implements expansionary fiscal policy that raises aggregate demand.Which of the following best goes with the diagram shown?

-Refer to Exhibit 16-10.Assume that the starting point is point 1.Suppose that the government implements expansionary fiscal policy that raises aggregate demand.Which of the following best goes with the diagram shown?

A) New classical theory with policy incorrectly anticipated,bias downward

B) New classical theory with policy incorrectly anticipated,bias upward

C) Real business cycle theory

D) New classical theory with policy unanticipated

E) Policy ineffectiveness proposition (PIP)

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 16-2  -Refer to Exhibit 16-2.Suppose the economy starts at point B.Fed monetary policy shifts the AD curve to AD1.A recession is likely if the economy operates under __________ assumptions,which include wage and price __________.

-Refer to Exhibit 16-2.Suppose the economy starts at point B.Fed monetary policy shifts the AD curve to AD1.A recession is likely if the economy operates under __________ assumptions,which include wage and price __________.

A) new classical;flexibility

B) new classical;inflexibilities

C) new Keynesian;flexibility

D) new Keynesian;inflexibilities

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Friedman natural rate theory implies that there is a tradeoff between inflation and unemployment in

A) neither the short run nor the long run.

B) both the short run and the long run.

C) the short run,but not in the long run.

D) the long run,but not in the short run.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 146

Related Exams