A) i only

B) i and ii

C) i,ii and iii

D) i and iii

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company starts work on 1000 physical units and completes 75 per cent of conversion activity.The costs are $1500 for conversion and $5000 for direct material.What is the cost per equivalent unit for conversion?

A) $1.00 per unit

B) $1.50 per unit

C) $2.50 per unit

D) $2.00 per unit

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

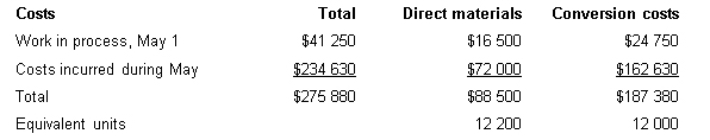

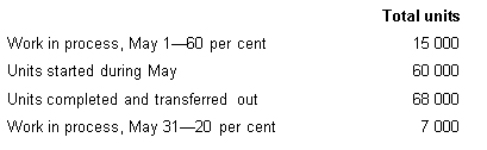

South River Chemicals Pty Ltd manufactures a product called Zybek.Direct materials are added at the beginning of the process and conversion activity occurs uniformly throughout the process.The following data pertain to the month of May.What are the unit costs for the period (rounded to two decimal places) assuming FIFO costing?

A) DM $7.25;CC $15.62

B) DM $5.90;CC $13.55

C) DM $5.90;CC $15.62

D) None of the given answers

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rex Company Ltd had 4000 units in work in process at 1 April.During April,11 000 units were completed.At 30 April,5000 units remained in work in process.How many units were started during April?

A) 11 000

B) 5000

C) 12 000

D) 16 000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rebex Chemical Company manufactures Compound 2 in two sequential departments.On June 1,Department 2 had 3000 units,which were 50 per cent complete as to conversion cost.During June,15 000 units were completed and transferred from Department 1.On June 30,Department 2 had 4000 units,which were 20 per cent complete as to conversion costs.How many units were completed and transferred from Department 2 during the month of June?

A) 11 000

B) 12 500

C) 14 000

D) 15 700

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Heara Ltd manufactures metal sheets and uses the weighted average method process costing.On 1 May the Rolling Department had 2 000 units work in progress,which were 20 per cent completed as to conversion costs.During May 10 000 units were completed and transferred out.The remaining work in progress on 30 May was 50 per cent complete in terms of conversion rate.If the equivalent unit is 12 000 units,what is the 30 May work in progress?

A) 4000 units

B) 2000 units

C) 8000 units

D) 5000 units

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume material is added at the beginning of a process,and the beginning WIP inventory is 30 per cent complete as to conversion costs.Using the FIFO method of costing,the total equivalent units for material for this process during this period is equal to:

A) units started this period in this process

B) units started this period in this process plus 70 per cent of beginning inventory

C) beginning inventory this period for the process

D) units started this period in this process plus the beginning inventory

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The difference in cost per equivalent units between the weighted average method and the FIFO method…

A) will be higher if there is no beginning work in process

B) will be higher if there is no ending work in process

C) will disappear if there is no beginning work in process

D) will be lower if there is no ending work in process

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the inventory formula that shows the physical flow of production units during a given month,under the weighted average method?

A) Physical units in beginning work in process + units started - units completed and transferred out = units in ending work in process.

B) Units in beginning work in process + units completed and transferred out + units started = units in ending work in process.

C) Units started + units completed and transferred out + units in ending work in process = units in beginning work in process.

D) Units in beginning work in process - units started + units completed and transferred out = units in ending work in process.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Abnormal spoilage is identified to assist managers in tracking the costs of wasted resources.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which of the following ways is normal spoilage accounted for?

A) Expensed in the period in which it occurred

B) Included as part of the unit cost of output

C) Written off to cost of goods sold

D) Included in inventory valuation until year-end and then written off

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company starts work on 1000 physical units and completes 75 per cent of conversion activity.The costs are $1500 for conversion and $5000 for direct material.What is the cost per equivalent unit for direct material?

A) $10.00 per unit

B) $5.00 per unit

C) $6.00 per unit

D) $6.67 per unit

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Process costing can be used in service businesses if the service is routine and repetitive.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Owl's Hours produces herbal tea and prides itself in having one of the largest ranges of herbal teas in Australia.It sells more than 50 varieties of tea leaves with a wide range of prices (depending on where the tea leaves are grown) .The production processes of its products is simple,but vary depending on whether the tea is sold as loose leaves (which requires packing tea leaves in various sized boxes) or tea bags (which requires additional process in packaging tea in specially designed tea bags) .Owl's Hours decides to use an operation costing system.This decision is:

A) Correct,because the company uses a large variety of tea leaves as direct materials and yet has simple production processes.

B) Correct,because the company uses a large variety of tea leaves as direct materials and the different products require different sequences of processes.

C) Incorrect,because the different production lines require the tea leaves to be packaged in very distinctive methods.

D) Incorrect,because the company has a very homogenous product - it produces and sells only tea.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inventory valuation in operation costing requires:

A) direct materials and conversion costs being traced to processes

B) direct material and conversion costs being traced to batches

C) direct materials traced to batches and conversion costs traced to processes

D) direct materials traced to processes and conversion costs traced to batches

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

South River Chemicals Pty Ltd manufactures a product called Zybek.Direct materials are added at the end of the process and conversion activity occurs uniformly throughout the process.The following data pertain to the month of May.Using the FIFO method of process costing,calculate the equivalent units of direct materials and conversion activity for the month of May.

A) DM 75 000;CC 69 400

B) DM 60 000;CC 60 400

C) DM 68 000;CC 69 400

D) None of the given answers

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are needed to calculate ending work in process under process costing? Unit cost Equivalent units Cost in beg.work in process

A) No

No

Yes

B) Yes

Yes

No

C) Yes

Yes

Yes

D) Yes

No

No

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Eldervale Winery produces premium wine in the Hunter Valley.During the bottling process,small amount of spillage is often unavoidable.How should the costs associated with the spillage be treated?

A) It should be included in the work in progress.

B) It should be expensed in the period the cost is incurred.

C) It should be ignored in the work in progress account and reported only in the internal production reports.

D) It should be expensed immediately under the FIFO method,but included in the work in progress in the weighted average method.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

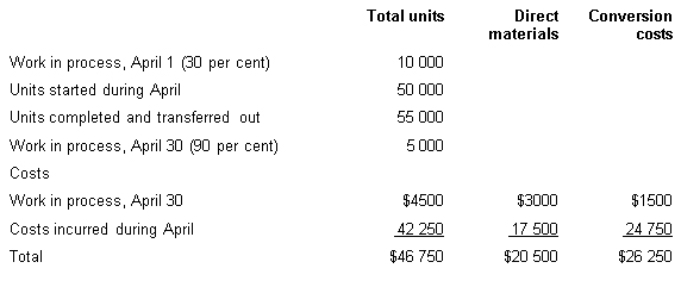

Healthy Flavour is a food processing company that makes a product called Health Nut soup in two processes-blending and condensing.The output of the blending department is transferred to the condensing department.All materials are added at the beginning of the blending process,and conversion activity occurs uniformly throughout both processes.The following data pertain to the month of April in the blending department.Using the FIFO method of process costing,calculate the cost per equivalent unit of conversion activity for the month of April.

A) $0.5048

B) $0.4169

C) $0.4381

D) None of the given answers

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

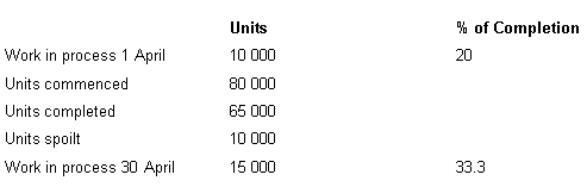

The following data apply to Zilch Ltd in its mixing department for the month of April.All material is introduced at the start of the process and conversion occurs evenly through the process.Spoilage occurred at the mid point in the process.Using the weighted average method,what are the equivalent units for conversion?

A) 85 000

B) 75 000

C) 77 000

D) 82 000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 73

Related Exams